pay indiana sales tax online

Sales and use tax television and. Streamlined Sales and Use Tax Project.

Indiana Files Online Sales Tax Suit

Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be.

. ATTENTION-- ALL businesses in Indiana must file and. You can file and pay sales and use tax electronically using the Departments free and secure File and Pay webpage or you may purchase software from a vendor. You have been successfully logged out.

Cookies are required to use this site. View call tips and peak schedule information. If you file electronically you can also pay your sales tax obligation through the portal.

The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes. FilePay Sales and Use Tax E-500 Pay Other Sales and Use Tax Using the eBusiness Center Login Registration Required Pay a Bill.

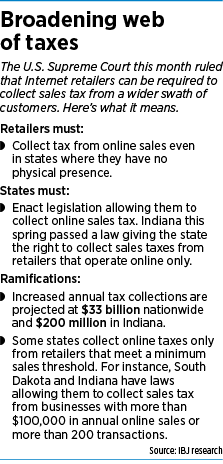

All sales and use tax returns and associated payments must be submitted electronically. You have gross revenue from sales into Indiana exceeding 100000. You may now close this window.

Your browser appears to have cookies disabled. You have 200 or more separate transactions into Indiana. You can process your required sales tax filings and payments online using the official INTax website which can be found here.

Welcome to the Indiana Department of Revenue. Ready to file your taxes. Filing electronically allows you full-time access to your tax records securely communicate with the.

Sales into Indiana or sales transactions include any. You should have received credentials to access your INTax. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients.

For questions regarding electronic filing or payment please email Electronic Reporting or call 800-442-3453. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1.

The Indiana Department of Revenue offers the following e-services portals for individual income tax customers business tax customers and motor carriers. We cover more than 300 local jurisdictions. File and Pay Electronically Using TNTAP.

Create a Tax Preparer Account. INTIME provides access to manage and. Pay your income tax bill quickly and easily using INTIME DORs e-services portal.

INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump. Returns and payments are.

Dor Unemployment Compensation State Taxes

Indiana Tax Refund Here S When You Can Expect To Receive Yours

Dentons Online Travel Company Not A Retail Merchant For Indiana Sales And Innkeeper S Tax

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

Sales Taxes In The United States Wikipedia

Local Firms Bristle At Supreme Court Sales Tax Ruling Indianapolis Business Journal

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Oops Here S What To Do If You Missed The Tax Deadline

Dor How To Make A Payment For Individual State Taxes

Sales Tax By State Is Saas Taxable Taxjar

Dor Individual Income Tax Return Electronic Filing Options

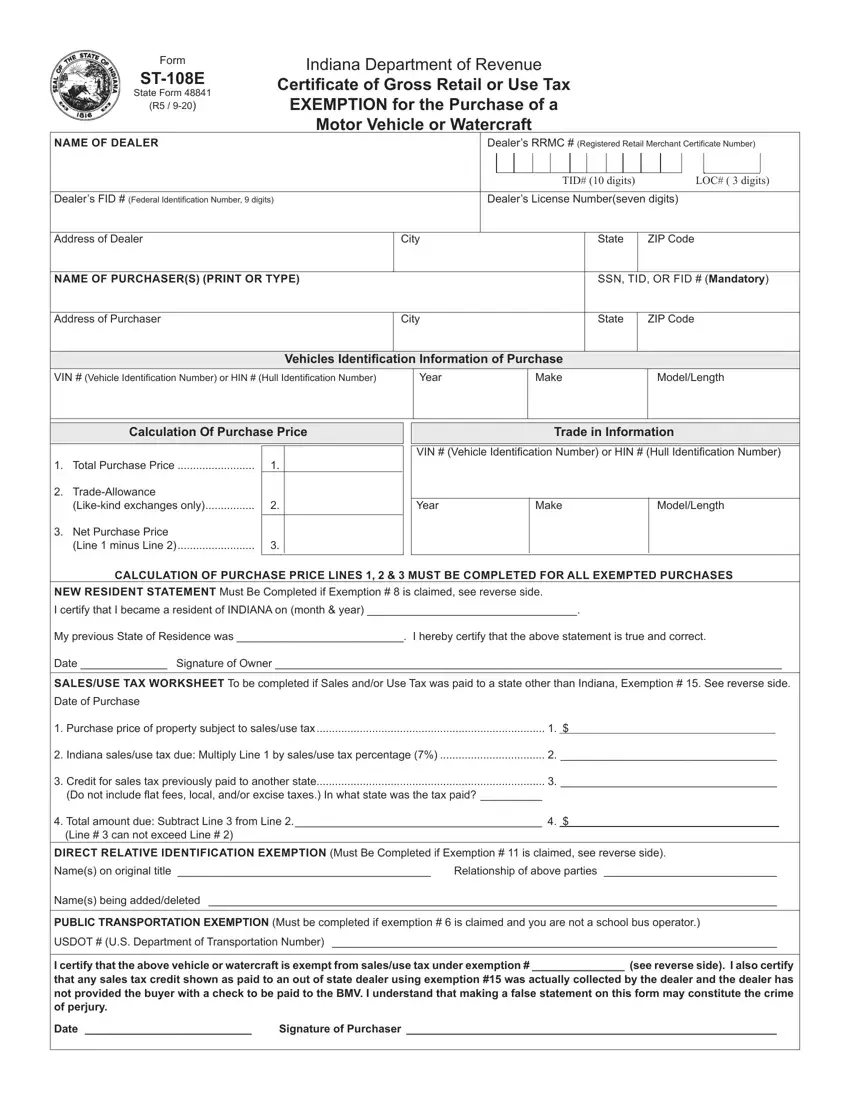

St 108e State Form Fill Out Printable Pdf Forms Online

Tax Credit Online Marketplace Creates Connections For More Deals Indianapolis Business Journal

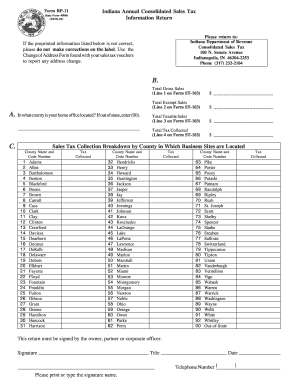

Indiana Annual Consolidated Sales Return Form Fill Out And Sign Printable Pdf Template Signnow

Indiana St 103 Fill Out Sign Online Dochub

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation